Crypto vs traditional investments – what works better?

The current climate of modern investing demands a keen understanding of both stocks and emerging assets. Investors seeking substantial returns must evaluate the inherent volatility associated with each option. While traditional equities have historically provided stable growth, the new wave of assets presents opportunities for rapid gains, albeit with heightened risk.

Understanding the characteristics of these markets is crucial. Stocks generally offer predictability and long-term appreciation but can fall victim to market fluctuations. On the other hand, newer asset classes may yield extraordinary returns but come with significant price swings that can unsettle even seasoned investors.

To navigate this complex environment effectively, diversification remains key. Allocating resources across various investment types can mitigate risks while capitalizing on potential growth opportunities. By balancing established stocks with innovative alternatives, investors position themselves for success in an unpredictable financial landscape.

Risk Factors in Investments

Prioritize understanding volatility; it significantly impacts returns. Bitcoin’s price swings can reach 10% or more within a single day, showcasing its unpredictable nature. In contrast, stocks generally exhibit more stable fluctuations, often staying within a 1-3% range during similar periods. This difference can lead to higher potential gains with cryptocurrencies but at the cost of increased risk.

Market sentiment plays a pivotal role in both asset classes. News and events can drive rapid changes in bitcoin’s price, resulting in substantial losses if not monitored closely. Stocks also react to news, but the effects are typically less drastic due to established company fundamentals and market conditions.

Regulatory risks present another layer of concern. Cryptocurrency regulations are still developing, which can cause sudden shifts in market dynamics. Companies listed on stock exchanges usually operate under clearer regulatory frameworks, providing more stability for investors.

Liquidity is crucial as well; while major cryptocurrencies like bitcoin enjoy high trading volumes, smaller coins may suffer from low liquidity, increasing the difficulty of executing trades without impacting prices significantly. Stocks tend to have better liquidity overall, especially blue-chip companies.

Diversification remains a key strategy regardless of the chosen assets. Allocating investments across various sectors and types–both digital currencies and equities–can mitigate risks associated with individual asset volatility.

Lastly, leverage amplifies risk. Margin trading is common in crypto markets and can lead to devastating losses if positions move against investors. Traditional stock trading typically offers less aggressive leverage options, reducing exposure to drastic downturns.

Liquidity Comparison Explained

Stocks typically offer higher liquidity compared to many digital currencies, allowing investors to execute trades rapidly without significantly impacting market prices. This is crucial for those seeking timely entry and exit points in their portfolios.

- Market Hours: Stock exchanges operate on defined schedules, generally providing consistent trading hours during which liquidity is high. In contrast, cryptocurrencies trade 24/7, leading to varying liquidity at different times.

- Order Types: Stocks support a range of order types that enhance liquidity management, such as limit orders and stop-loss orders. While similar options exist in the crypto space, they may not function as reliably due to platform volatility.

- Volume: High trading volumes in stocks contribute to liquidity, enabling quicker transactions. Many cryptocurrencies experience lower volumes, especially smaller cap coins, which can lead to wider spreads and slippage.

Investors should be cautious about the potential for increased volatility in less liquid markets. Larger price swings can occur with minimal trading activity, complicating risk management strategies. Understanding liquidity dynamics is essential for optimizing returns across various asset classes.

- Diversification Strategies: Consider allocating assets across both stocks and cryptocurrencies to balance liquidity profiles while aiming for optimal returns.

- Real-Time Monitoring: Utilize tools that provide real-time data on market depth and order books to make informed decisions based on current liquidity conditions.

- Exit Strategies: Develop clear exit plans that account for the differing liquidity characteristics of your investments to minimize losses during volatile periods.

A thorough grasp of these factors will equip you with the insights necessary for navigating your investment journey effectively. Balancing the benefits of high liquidity with potential returns will enhance overall portfolio performance.

Tax Implications for Investors

Understand the tax obligations tied to your assets, whether they are derived from bitcoin transactions or conventional market activities. In many jurisdictions, any profit realized from selling these assets is subject to capital gains taxes. For cryptocurrencies, this includes both short-term and long-term holding periods, influencing the applicable rate significantly.

Short-term capital gains arise when assets are held for less than a year and are taxed at ordinary income rates, which can be considerably higher due to individual tax brackets. Long-term holdings may benefit from reduced rates, often appealing for those aiming for substantial returns over time.

Documentation plays a crucial role in ensuring compliance. Keep detailed records of purchase prices, sale prices, and transaction dates. This practice not only aids in accurate reporting but also protects against potential audits. The volatility of cryptocurrencies means that values can fluctuate dramatically within short periods; thus, precise tracking is indispensable.

Moreover, some regions offer specific tax incentives or exemptions related to digital currencies. Research local regulations thoroughly to identify opportunities that could enhance overall profitability. Always consider consulting with a tax professional familiar with modern investing strategies to navigate complex scenarios involving asset disposition effectively.

Lastly, be aware of the implications surrounding inheritance and estate planning as well. Digital assets may be treated differently than traditional ones upon transfer after death; understanding these nuances can prevent unforeseen complications for heirs.

Long-Term Growth Potential

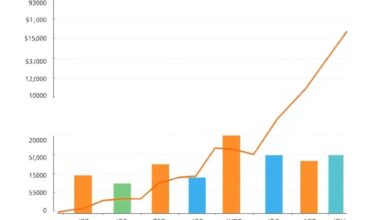

For those focused on maximizing returns, investing in bitcoin and stocks presents distinct opportunities. Historical data indicates that while stocks have shown a consistent upward trajectory over decades, the potential for exponential growth in cryptocurrencies cannot be overlooked.

Investors should consider asset allocation strategies that include both bitcoin and equities to harness the benefits of each. Stocks typically offer stable growth, backed by company performance and market fundamentals. In contrast, bitcoin’s volatility can lead to remarkable price surges, although accompanied by substantial risks.

The stark contrast in returns highlights bitcoin’s capacity for rapid appreciation, but also underscores its susceptibility to sharp declines. Investors willing to embrace this volatility could see significant long-term gains if they maintain a disciplined approach.

Diversifying across both asset types can balance risk and reward. While stocks may provide stability, incorporating a smaller percentage of bitcoin could enhance overall portfolio growth potential. Long-term holders of bitcoin have historically benefited from market cycles, suggesting that patience is key for achieving significant returns in this dynamic environment.

A prudent investment strategy should evaluate individual risk tolerance and financial goals while embracing the unique attributes of each asset class. By doing so, investors can optimize their portfolios for sustained growth in an increasingly modern investing landscape.