How to invest in multiple currencies and manage risks

Allocate a portion of your portfolio across various global markets to achieve a balanced approach to currency holdings. By engaging in this practice, you not only tap into the potential upside of differing economic conditions but also shield your assets from localized downturns.

Diversification is key. Consider including both major currencies such as the US Dollar, Euro, and Yen alongside emerging market currencies. This variety helps balance out fluctuations, as different economies respond uniquely to geopolitical events and economic indicators.

Monitor exchange rates closely, utilizing tools that provide real-time data on currency performance. Establish thresholds for intervention when certain currencies deviate significantly from their historical norms. This proactive stance enables you to make informed decisions that protect your investments while capitalizing on opportunities.

Lastly, always reassess your exposure regularly. Market dynamics shift, and so should your strategy. Adapting your currency mix based on current trends will enhance both growth prospects and safeguard against unforeseen risks.

Understanding Currency Diversification

To achieve a balanced portfolio, consider allocating assets across various monetary units. This strategy mitigates exposure to fluctuations in any single currency. By spreading investments internationally, one can tap into the growth potential of global markets while buffering against localized economic downturns.

Choosing diverse currencies allows investors to harness strengths from different economies. For instance, pairing stronger currencies with those that may be undervalued offers opportunities for appreciation when market conditions shift. Look at economic indicators such as GDP growth rates and inflation levels to identify promising options.

Regularly rebalancing your portfolio is vital. As currency values fluctuate, maintaining a target allocation ensures that no single unit dominates your holdings, preserving the intended balance. Periodic assessments can help adjust positions based on changing global dynamics and personal financial goals.

Utilizing hedging techniques, such as options or futures contracts, can further protect against adverse movements in exchange rates. These tools enable locking in prices and reducing volatility impact on overall returns.

By strategically diversifying across various currencies, investors position themselves advantageously within the interconnected fabric of global finance while minimizing risks associated with currency depreciation or economic instability in specific regions.

Identifying Currency Risks

To mitigate exposure in the forex market, it’s essential to recognize key factors contributing to currency volatility:

- Political Stability: Monitor geopolitical events and government policies that may affect currency value.

- Economic Indicators: Analyze data such as GDP growth, unemployment rates, and inflation. These metrics directly influence currency strength.

- Interest Rates: Pay attention to central bank decisions. Fluctuations in interest rates can lead to significant shifts in exchange rates.

- Market Sentiment: Gauge investor sentiment through news reports and market trends. Emotional responses can drive rapid price changes.

Diversification across various currencies can help balance risk. Consider allocating investments based on correlation coefficients, which measure how closely related two currencies are. A lower correlation suggests that diversifying between these assets may reduce overall portfolio volatility.

- Currency Pairs: Select pairs with differing economic conditions to enhance protection against localized downturns.

- Currencies of Emerging Markets: Assess their potential for growth but remain cautious of inherent instability.

A robust strategy includes employing tools such as options or futures contracts to hedge against adverse movements in the forex space. Regularly review your holdings and adjust allocations based on current market assessments to maintain a balanced approach towards risk exposure.

Strategies for Hedging Risks

Utilize currency options to secure favorable exchange rates while maintaining flexibility in your trading decisions. This method allows you to buy or sell a specific amount of foreign currency at a predetermined rate, safeguarding against adverse movements in the forex market.

Implement forward contracts to lock in current rates for future transactions. By agreeing on an exchange rate today for a transaction that will occur later, you can effectively manage potential fluctuations and stabilize cash flow across global markets.

Consider diversifying investments across various currencies. Spreading assets can minimize exposure to any single currency’s volatility, balancing overall portfolio risk and enhancing potential returns from different economic regions.

Utilize currency ETFs (Exchange-Traded Funds) as a hedge. These funds allow investors to gain exposure to multiple currencies without direct trading, providing an easy mechanism for diversification while mitigating risks associated with individual currencies.

Incorporate currency swaps in your strategy. This involves exchanging principal and interest payments in one currency for another, offering a way to manage cash flow needs while hedging against unfavorable exchange rate movements.

Stay informed about geopolitical developments and economic indicators that may impact currency values. Understanding these factors can enhance decision-making processes related to forex positions and help anticipate shifts in the market landscape.

Use stop-loss orders strategically to limit potential losses on trades. Setting predefined exit points can automatically close positions if market conditions move against you, preserving capital and reducing emotional trading decisions.

Engage in active monitoring of correlations between currencies. Identifying relationships among different pairs can provide insights into potential risks and opportunities, allowing for more informed adjustments within your diversified portfolio.

Monitoring Currency Performance

Utilize real-time data feeds and analytical tools to track fluctuations in foreign exchange rates. Platforms like Bloomberg Terminal or TradingView provide comprehensive insights into market trends, enabling precise decision-making.

Establish key performance indicators (KPIs) for each currency within your portfolio. Monitor metrics such as volatility, liquidity, and correlations with global markets. Understanding these factors helps assess potential risks and rewards effectively.

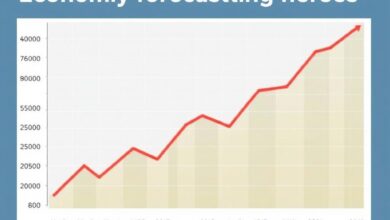

Incorporate technical analysis by utilizing charts that highlight historical price movements. This approach aids in identifying patterns that may indicate future behavior of currencies against one another.

Engage with economic indicators that impact forex trading, such as interest rates, inflation data, and employment statistics. Regularly review central bank policies as they significantly influence currency values through monetary policy adjustments.

Consider setting alerts for significant market movements or news releases that could affect currency valuations. This proactive measure ensures timely responses to emerging opportunities or threats in the forex market.

Lastly, diversify your sources of information. Relying on a single outlet can lead to biased perspectives. Integrate insights from multiple analysts and reports to form a well-rounded view of currency performance.

Tools for Currency Investment

Utilize trading platforms like MetaTrader 4 or TradingView, which offer real-time data analysis, advanced charting tools, and customizable indicators. These platforms facilitate precise decision-making in global markets.

Consider currency ETFs (Exchange-Traded Funds) that provide exposure to various foreign exchange assets without the complexities of managing multiple accounts. This approach simplifies diversification while maintaining a balanced portfolio.

Employ risk assessment software such as Value at Risk (VaR) tools that quantify potential losses in currency positions. This aids in understanding exposure levels across different market conditions.

Explore automated trading systems that execute trades based on predefined algorithms, helping to mitigate emotional decision-making and optimize entry and exit points in volatile environments.

Leverage economic calendars to track crucial macroeconomic events affecting currency fluctuations. Being informed about interest rate changes, geopolitical developments, and economic indicators is vital for strategic positioning.

Incorporate mobile apps for on-the-go monitoring of currency performance. Having access to market updates ensures timely adjustments to your strategy, enhancing responsiveness in dynamic situations.

Utilize hedging instruments like options and futures contracts to protect against unfavorable currency movements. Understanding how these derivatives function can significantly reduce exposure to adverse shifts in exchange rates.

Lastly, engage with analytical tools that provide insights into correlations between currencies. Recognizing relationships can lead to more informed choices regarding asset allocation and risk distribution across your portfolio.