How to invest in renewable energy projects

Consider allocating your resources into sectors that prioritize sustainability and clean alternatives. By focusing on green investing, you align your portfolio with the principles that are shaping tomorrow’s economy. The global shift towards environmental consciousness opens up lucrative opportunities for those willing to engage in innovative ventures.

Engage with projects centered around solar, wind, or bioenergy. These avenues not only contribute positively to the planet but also yield promising financial returns. Statistics show that investments in clean solutions have consistently outperformed traditional sectors over the last decade, highlighting their potential for growth.

Research companies that demonstrate a commitment to reducing carbon footprints and promoting eco-friendly practices. Assess their long-term strategies and market positions; those with clear sustainability goals often attract more investor interest and exhibit resilience against market fluctuations.

Stay informed about government incentives aimed at boosting green initiatives. Tax benefits and grants can significantly enhance the profitability of your investments while reinforcing your role in fostering a sustainable future. Each decision you make contributes to building a cleaner environment and supporting industries dedicated to responsible practices.

Understanding Renewable Energy Types

Solar power stands out as a leading option, providing attractive returns through the installation of photovoltaic systems. This technology converts sunlight directly into electricity, benefiting from decreasing installation costs and favorable government incentives.

Wind turbines harness kinetic energy from air currents. Onshore and offshore setups can yield significant profits, particularly in regions with consistent wind patterns. The scalability of these systems allows for both small and large investments, appealing to various investor profiles.

Hydropower utilizes flowing water to generate electricity. It remains a reliable source due to its established infrastructure and capacity for energy storage. Small-scale hydropower installations offer opportunities for localized green investing while ensuring sustainability in energy production.

Biomass energy is derived from organic materials, including agricultural waste and wood products. This method not only provides an alternative fuel source but also contributes to waste management solutions. Investors should explore projects that emphasize innovative technologies for biomass conversion.

Geothermal systems extract heat from the Earth’s core, offering a steady and sustainable energy source. This type of clean energy has the potential for long-term profitability, especially in geologically favorable areas.

Each category presents unique opportunities aligned with sustainability goals. Understanding these types helps in making informed decisions that contribute positively to both financial growth and environmental stewardship.

Evaluating Investment Opportunities

Focus on assessing potential returns and the long-term viability of the chosen venture. Analyze key performance indicators (KPIs) relevant to clean alternatives, such as:

- Projected Financial Returns: Estimate cash flows and compare with initial capital outlay. Aim for projects with clear profit margins.

- Regulatory Environment: Understand local and national policies affecting sustainability initiatives. Incentives can significantly improve profitability.

- Technology Assessment: Evaluate the reliability and efficiency of technologies used in the operation. Advanced systems often yield better outcomes.

- Market Demand: Research current trends in clean alternatives. Growing consumer interest indicates a robust future market.

- Operational Expertise: Review the management team’s experience. A knowledgeable team enhances project execution and risk management.

Utilize financial modeling tools to simulate various scenarios, ensuring that even under adverse conditions, returns remain attractive. Prioritize investments that contribute not only to personal wealth but also promote sustainability practices.

Finally, consider diversification across different types of clean solutions–wind, solar, or bioenergy–to mitigate risks associated with market fluctuations while enhancing overall portfolio stability.

Risk Assessment Strategies

Implement scenario analysis to evaluate various future outcomes based on market trends, regulatory changes, and technological advancements. This approach helps anticipate potential risks and gauge their impact on returns.

Conduct sensitivity analysis to understand how fluctuations in key variables–like energy prices or operational costs–affect project viability. By adjusting these parameters, investors can identify critical thresholds that could jeopardize sustainability.

Utilize diversification across different sectors within the clean technology sphere. This strategy mitigates risks associated with investing heavily in a single type of asset or region, thereby enhancing overall portfolio stability.

Incorporate environmental, social, and governance (ESG) criteria into evaluations. Projects with strong ESG performance are often more resilient against regulatory shifts and public scrutiny, leading to more sustainable returns in the long run.

Engage with local communities and stakeholders early in the process. Their insights can provide valuable information regarding potential challenges and opportunities that may not be apparent from a distance.

Monitor policy developments closely. Government incentives or penalties can greatly affect the financial landscape of green investments; staying informed allows for timely adjustments to investment strategies.

Financing Options Explained

Consider green bonds. These instruments finance environmentally friendly initiatives while offering competitive interest rates. They attract investors focused on sustainability and can yield attractive returns over time.

Crowdfunding platforms are gaining traction. They allow individuals to pool resources for innovative ventures, reducing the financial burden on a single investor. Many platforms specialize in eco-friendly initiatives, providing transparency and community engagement.

Private equity funds often target sustainable sectors. By investing in these funds, you can gain access to a diversified portfolio of companies committed to environmental stewardship. Assess their track records for performance metrics before committing your capital.

Government grants and incentives are available in many regions. They aim to stimulate investments in sustainability-focused enterprises. Research local programs that support such endeavors; they might significantly enhance your potential returns.

Power Purchase Agreements (PPAs) offer long-term contracts that guarantee fixed prices for electricity generated from sustainable sources. This stability appeals to investors seeking predictable cash flows while supporting the transition towards greener alternatives.

Community investment schemes enable local stakeholders to finance projects directly impacting their environment. This approach fosters a sense of ownership and accountability, contributing positively to both returns and community resilience.

Selecting the right financing option aligns with your commitment to sustainability while maximizing future returns. Thoroughly evaluate each choice based on risk tolerance and desired impact on the environment.

Measuring Project Success

Establish clear metrics to assess the achievement of green initiatives. Focus on quantifiable outcomes such as energy output, cost savings, and carbon footprint reduction to gauge performance.

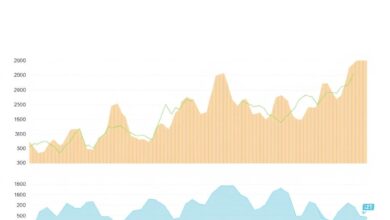

Utilize dashboards that provide real-time data analytics to track these metrics effectively. This allows for timely adjustments, ensuring projects stay aligned with financial projections and sustainability commitments.

Engagement with stakeholders through transparent reporting enhances trust and encourages continued support. Regular updates on performance against set targets can solidify confidence in the project’s future viability and its contributions to green investing strategies. Aim to establish benchmarks based on industry standards for comparative analysis, enabling continuous improvement over time.

The interplay between returns, operational efficiency, and environmental benefits creates a robust framework for assessing success in this sector. Prioritize establishing a culture of accountability that values both fiscal responsibility and ecological integrity as foundational elements for long-term achievements.