How to retire early with the FIRE method

Focus on aggressive savings and investment strategies that can lead to a life of independence. Aim to set aside at least 50% of your income, redirecting those funds into low-cost index funds or real estate investments. This approach can significantly accelerate wealth accumulation, allowing you to break free from traditional work schedules.

Monitor your expenses closely and adopt a minimalist lifestyle. By reducing unnecessary costs, you create more opportunities for savings. Consider tracking your spending with budgeting tools to identify areas where you can cut back without sacrificing quality of life.

Engage in continuous learning about personal finance and investment options. Knowledge is power; the more informed you are, the better decisions you can make regarding your financial future. Explore resources like books, podcasts, and online courses dedicated to finance and investing.

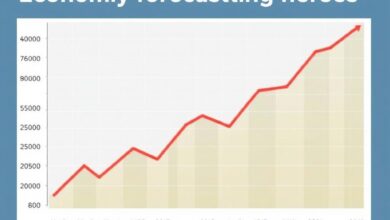

Create a detailed financial plan that outlines your goals and milestones. Include specific targets for savings, investments, and net worth over time. Regularly review and adjust this plan as needed to stay aligned with your aspirations for freedom from conventional employment.

Understanding FIRE Principles

Prioritize detailed financial planning to create a roadmap towards freedom. Calculate your desired annual spending and multiply it by 25; this figure represents the necessary savings to sustain your lifestyle indefinitely.

Invest aggressively in diversified assets, focusing on stock market indices and low-cost index funds. The goal is to build a robust portfolio that grows over time, outpacing inflation while minimizing risk through diversification.

Monitor your expenses rigorously. Identify areas where you can cut costs without sacrificing quality of life. Adopt a minimalist approach; reducing unnecessary expenditures allows for increased savings rates, which accelerates wealth accumulation.

Create multiple income streams. Explore side hustles or passive income opportunities such as real estate investments or dividend-paying stocks. This not only supplements your primary income but also builds resilience against market fluctuations.

Engage in continuous learning about personal finance and investment strategies. Attend workshops, read books, and follow reputable financial blogs. Knowledge empowers you to make informed decisions that enhance financial stability.

Set specific milestones to track progress towards achieving fiscal independence. Regularly reassess your goals and adjust your strategy as needed, ensuring alignment with changing circumstances and aspirations.

Embrace a frugal mindset while still enjoying life’s pleasures. Balance is key; prioritize experiences over material possessions to enrich your journey towards financial freedom.

Cultivate a supportive community of like-minded individuals who share similar objectives. Networking with others on the same path provides motivation, accountability, and valuable insights from shared experiences.

The principles laid out here form the backbone of an effective strategy aimed at securing long-term financial freedom, allowing for an escape from traditional work structures sooner than expected.

Calculating Your FIRE Number

Your financial independence target is calculated by taking your annual expenses and multiplying them by 25. This formula stems from the principle that a withdrawal rate of 4% per year allows for sustainable living without depleting your assets.

Begin with a comprehensive assessment of your yearly expenditures. Include all necessary costs: housing, utilities, food, healthcare, taxes, and discretionary spending. Aim for a realistic budget that reflects your lifestyle aspirations.

Once you have determined your annual expenses, apply the multiplier to find your fire number. For instance, if you spend $50,000 annually, your target would be $1.25 million ($50,000 x 25). This figure represents the capital needed to sustain your desired lifestyle indefinitely through prudent investment strategies.

Adjustments may be necessary based on personal circumstances or market conditions. Consider factors such as inflation, potential income sources during retirement years (like part-time work), and changes in spending habits over time.

Track and reassess this number periodically as life situations evolve or financial markets fluctuate. Being proactive in planning helps maintain clarity and ensures you’re on track toward achieving true freedom in managing finances.

Strategies for Cutting Expenses

Reduce housing costs by considering alternative living arrangements. Renting a smaller space, moving to a less expensive area, or even house hacking can significantly lower your monthly outlay.

- Evaluate current living situation: Explore options like shared accommodations or relocating to regions with lower housing costs.

- Negotiate rent: Approach landlords about potential discounts or incentives for longer lease terms.

Grocery bills can take a large chunk of your budget. Implementing meal planning and bulk buying strategies can lead to substantial savings.

- Create a weekly meal plan based on sales and seasonal produce.

- Purchase in bulk for non-perishable items to reduce unit costs.

Transportation expenses often go unnoticed. Consider alternatives that promote financial freedom.

- Use public transportation, bike, or walk whenever possible to minimize vehicle-related expenditures.

- If owning a car is necessary, explore options like carpooling or ridesharing services to cut down on fuel and maintenance costs.

Review subscription services and memberships regularly. Cancel any unused or unnecessary subscriptions that drain finances without adding value.

- Conduct an audit of all recurring charges and eliminate those that don’t align with your current lifestyle goals.

- Consider free alternatives for entertainment, such as community events or local libraries.

Utility bills can be trimmed by adopting energy-efficient habits. Simple changes can translate into significant savings over time.

- Switch to LED bulbs and unplug devices when not in use to reduce electricity consumption.

- Adjust thermostat settings seasonally; small tweaks can lead to noticeable reductions in heating and cooling costs.

Cultivate a frugal mindset by prioritizing needs over wants. This approach fosters financial independence through conscious spending habits.

- Create a budget that reflects true priorities and stick to it rigorously.

- Challenge yourself with 30-day no-spend challenges to curb impulse purchases.

Tightening your budget doesn’t mean sacrificing quality of life; rather, it leads to greater freedom in pursuing passions outside of work while building wealth for the future. Consistent efforts in cutting expenses pave the way toward financial self-sufficiency and personal satisfaction.

Investing for Passive Income

Focus on dividend stocks as a primary source of passive income. Look for companies with a strong history of increasing dividends and solid financials. Aim for a yield of at least 3-5% to ensure that your investments generate sufficient cash flow.

Consider real estate investment trusts (REITs) as another avenue. They typically offer attractive yields and can provide diversification away from traditional stock investments. Research REIT sectors like healthcare or residential to identify potential growth opportunities.

Bonds can also play a significant role in your portfolio. Opt for high-quality corporate or municipal bonds, which may offer better returns than government bonds while still providing stability. Allocate a portion of your investments to bond funds for easier management.

Peer-to-peer lending platforms allow you to lend money directly to individuals or businesses. This alternative investment can yield higher returns compared to traditional savings accounts, though it comes with increased risk. Diversify across multiple loans to mitigate potential losses.

Create an automated investment strategy using robo-advisors or target-date funds, allowing your capital to grow without constant oversight. This approach simplifies the planning process and reduces emotional decision-making during market fluctuations.

Diversifying income sources is key to achieving financial independence. Combining different types of passive income will buffer against market volatility and enhance overall cash flow stability, supporting your long-term goals of leaving the workforce behind sooner than later.

Navigating Healthcare Costs

Prioritize a Health Savings Account (HSA) to manage medical expenses tax-efficiently. Contributions reduce taxable income, and funds grow tax-free when used for qualified healthcare costs.

Assess your insurance options early. If eligible for Medicare or other programs, understand their coverage thoroughly. Research supplemental plans that align with your needs.

Consider the long-term implications of healthcare premiums in your financial strategy. Estimate future medical expenses based on current health trends and family history, as this will help in accurate budgeting.

Engage in preventive care to minimize potential high-cost treatments. Regular check-ups and screenings can catch issues before they escalate, saving money in the long run.

Explore telemedicine services for non-emergency consultations. These often come at a lower cost compared to traditional office visits while providing convenient access to healthcare professionals.

Factor in lifestyle choices that impact health and costs; adopting a nutritious diet and maintaining an active lifestyle can lead to significant savings on healthcare over time.

Create a dedicated budget line for medical expenses within your financial planning framework. This ensures you’re prepared for any unexpected costs without derailing your financial independence goals.

Stay informed about changes in healthcare policies that might affect out-of-pocket expenses. Adjusting your strategy according to these shifts can help maintain stability in financial planning.