How to set and prioritize your financial goals

Identify what truly matters in your life by aligning specific aspirations with a well-structured budget. Begin by categorizing these ambitions into short-term and long-term objectives, ensuring clarity in your vision. This method allows you to focus on immediate needs while keeping an eye on future achievements.

Planning effectively requires discipline. Allocate resources to each goal based on urgency and importance. For instance, if purchasing a home ranks high, dedicate a portion of your income towards savings for a down payment. Conversely, set aside smaller amounts for less pressing desires, such as travel or luxury items.

Creating a realistic budget is fundamental. Use tracking tools to monitor expenses and adjust spending habits accordingly. By understanding where every dollar goes, you can redirect funds towards fulfilling those prioritized dreams without compromising daily living.

Lastly, stay committed to the plan. Regularly review progress towards these aspirations and adjust as necessary. Life circumstances may shift, so flexibility combined with discipline will ensure that your financial strategy remains aligned with evolving desires.

Identify Your Financial Aspirations

Begin with a clear vision of what you want to achieve. Outline specific aspirations such as purchasing a home, saving for retirement, or funding education. This clarity will drive your planning efforts.

Utilize tracking tools to monitor your progress towards these aspirations. Regularly review your financial status against your targets to stay on course.

Create a budget that aligns with your ambitions. Allocate funds appropriately, ensuring that essential expenses do not derail your plans. Prioritize contributions to savings and investments that support your long-term vision.

Discipline is key. Stick to the budget while adjusting it as necessary based on changing circumstances or new opportunities that arise. Stay committed to your objectives, even when faced with challenges.

Set milestones along the way to celebrate small victories. These achievements will reinforce your motivation and provide insights into areas needing improvement.

Engage in regular reflections on your aspirations and progress. This practice will help maintain focus and make informed adjustments as life unfolds.

Assess Current Financial Situation

Begin with a detailed evaluation of your monetary landscape. Gather all statements, bills, and income records to create an accurate picture of where you stand.

- Income Review: Document all sources of revenue. Include salaries, bonuses, investments, and any side hustles.

- Expense Analysis: Track monthly outflows. Categorize spending into fixed (rent, utilities) and variable (entertainment, dining).

- Debt Inventory: List outstanding obligations. Include credit cards, loans, and mortgages along with their respective interest rates.

A comprehensive understanding of these elements enables better decision-making regarding future ambitions.

Create a Budget

Establish a disciplined budget that aligns with life goals. Allocate funds according to priorities identified in previous sections.

- Set Limits: Define spending caps for each category based on historical data.

- Savings Target: Dedicate a portion of income for savings or investment opportunities that support long-term aspirations.

- Review Regularly: Schedule monthly assessments to track adherence to the budget and make necessary adjustments.

This systematic approach not only helps in tracking expenses but also ensures that resources are directed toward fulfilling key objectives while minimizing unnecessary financial stress.

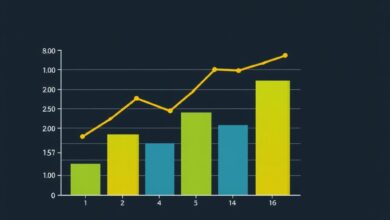

Create a Goal Timeline

Establish specific deadlines for each aspiration. Break down larger ambitions into smaller, actionable steps, assigning realistic timeframes to each. For instance, if saving for a home is a key target, determine how much you need and set monthly savings milestones.

Utilize a budgeting tool or spreadsheet to monitor progress. Regular tracking enables adjustments in spending habits and highlights areas where you can cut back to accelerate your savings. Designate periodic reviews–monthly or quarterly–to evaluate how well you are adhering to your timeline.

Incorporate life goals into your planning. Consider events like education expenses, retirement, or travel when forming your timeline. Align these aspirations with financial benchmarks to ensure comprehensive coverage of your future needs.

Be flexible; timelines may require revisions based on unforeseen circumstances or changes in priorities. Adaptability in your approach will enhance long-term success in achieving these significant objectives.

Review and Adjust Regularly

Conduct periodic evaluations of your financial strategy. Schedule reviews at least quarterly to assess progress against objectives. Analyze actual spending versus your planned budget, identifying areas for improvement.

Utilize tracking tools to monitor expenses and income. This data reveals patterns that can influence future planning. If certain goals are not being met, determine whether they require adjustments or if new priorities should be established.

Maintain discipline in your approach. Stick to your budgets while remaining flexible enough to adapt to unforeseen changes in circumstances or market conditions. Review interest rates, investment performance, and economic indicators regularly; these factors can affect the viability of existing aspirations.

Consider engaging with a financial advisor periodically to gain insights into optimizing your strategies. Their expertise may uncover opportunities previously overlooked, enhancing your potential for success.