Investing in gold – pros, cons and current trends

For those looking to enhance their portfolio, incorporating a precious metal can serve as an effective inflation hedge. Historically, this asset has maintained its status as a reliable store of value, particularly during periods of economic uncertainty. Current market conditions suggest that diversifying into this asset class may provide stability and protection against market volatility.

On the flip side, potential investors must weigh the risks associated with price fluctuations and storage costs. While some see it as a safe haven, others question its performance compared to traditional equities. Understanding these dynamics is crucial for informed decision-making in your financial strategy.

The recent surge in demand reflects shifting investor sentiment towards tangible assets amidst fears of inflationary pressures. Tracking these movements can reveal valuable insights into market behavior and help you make strategic choices for your financial future.

Understanding Gold’s Value

Consider allocating a portion of your portfolio to this precious metal as a reliable store of value, especially during periods of economic uncertainty. Historically, it has acted as a safe haven, maintaining its worth when other assets falter.

The intrinsic appeal lies in its scarcity and universal acceptance. Unlike fiat currencies, this commodity is not subject to inflationary pressures in the same manner; it often serves as an effective hedge against rising prices. During inflationary cycles, investors typically turn to this asset to preserve purchasing power.

Evaluate market conditions regularly. Demand from central banks and emerging markets can significantly influence pricing dynamics. Stay informed on geopolitical developments and economic indicators that may impact investor sentiment towards this asset class.

Incorporating a small percentage–typically between 5% and 10%–of your portfolio can enhance overall stability and reduce volatility. This allocation provides both protection and potential growth without overexposing your financial strategy to risks associated with more volatile assets.

As you consider these factors, remember that timing and market conditions play a critical role in maximizing returns while minimizing risks associated with fluctuations in value.

Investment Strategies Explained

Consider allocating a portion of your portfolio to physical bullion or reputable ETFs that track precious metals. This method provides a tangible asset that acts as a safe haven during economic downturns.

Utilizing dollar-cost averaging can mitigate volatility risks. Regularly invest a fixed amount, regardless of market conditions, ensuring acquisition over time at varying prices. This strategy reduces the impact of short-term fluctuations.

For those seeking liquidity, options trading on gold futures can be advantageous. It allows investors to benefit from price movements without the need for full capital investment in physical assets. However, this approach requires understanding of market trends and risk management practices.

Incorporating gold into a diversified portfolio enhances stability and serves as a store of value against inflation and currency devaluation. Regularly reassess your allocation based on macroeconomic factors and personal financial goals.

Leveraging mining stocks can also provide exposure to the metal’s price movements while offering potential dividends. However, it’s crucial to evaluate individual company performance and geopolitical risks associated with mining operations.

Finally, stay informed about global economic indicators that influence demand for precious metals–such as interest rates, geopolitical tensions, and currency strength–to refine your strategies effectively.

Risks of Gold Investments

Investing in precious metals presents unique challenges. One primary concern is price volatility, which can be influenced by geopolitical tensions, currency fluctuations, and changes in market sentiment. Investors should monitor these factors closely to avoid significant losses.

Storage and security pose additional risks. Physical assets require proper safeguarding against theft or damage, which can incur extra costs for insurance and secure storage solutions. Consider these expenses as part of your overall strategy.

Liquidity risk also merits attention. Unlike equities or bonds, selling physical gold may take time and could involve transaction fees that diminish returns. Always evaluate the ease of converting assets back into cash within your investment timeframe.

Another aspect to consider is the lack of yield. While many investments generate dividends or interest, precious metals simply act as a store of value without providing regular income streams. This absence may impact long-term financial planning if not accounted for appropriately.

Lastly, psychological factors can influence decision-making. Fear during market downturns might lead to hasty sales, negating potential gains when prices rebound. A disciplined approach to managing emotions is essential for maintaining a balanced portfolio amidst market fluctuations.

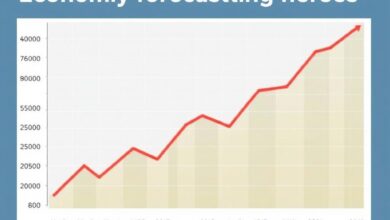

Market Trends Analysis

Monitor the prevailing forces shaping demand for this precious metal. The recent uptick in global economic uncertainty has heightened its status as a reliable store of value. Investors are increasingly turning to it as an inflation hedge, particularly in environments where central banks maintain low interest rates.

- Inflation Rates: Watch for shifts in inflation data; rising costs often drive interest toward this asset class.

- Geopolitical Tensions: Conflicts and political instability can lead to spikes in buying activity as individuals seek a safe haven amidst turmoil.

- Currency Fluctuations: A weakening currency typically boosts appeal, reflecting a desire to preserve wealth against devaluation.

- Central Bank Policies: Acquaint yourself with monetary policy changes; aggressive easing measures may spark increased accumulation by institutional players.

The current market exhibits signs of robust demand. Recent reports indicate a surge in purchases from both retail investors and large institutions, further solidifying its role in diversified portfolios. Pay close attention to emerging markets where demand is accelerating due to rising middle classes seeking stability in their investments.

- Analyze historical price movements relative to economic indicators.

- Diversify holdings; consider incorporating derivatives or exchange-traded products that track price fluctuations.

- Stay informed on technological advancements impacting mining and production costs, which can influence supply dynamics.

A proactive approach in monitoring these developments will enhance decision-making capabilities and optimize positioning within this sector. Adjust strategies based on comprehensive analysis, ensuring alignment with broader economic trends and personal risk tolerance levels.

Future Predictions for Gold

As inflation rates continue to rise, consider allocating a portion of your portfolio towards precious metals as a reliable inflation hedge. Analysts predict that the demand for this asset class will increase as more investors seek a dependable store of value amid economic uncertainties.

Expect fluctuations in pricing influenced by global geopolitical tensions, which consistently enhance its appeal as a safe haven. Historical data suggests that during times of crisis, prices tend to soar, reinforcing its role as an insurance policy against market volatility.

The integration of new technologies and sustainable mining practices may also impact future supply dynamics, potentially leading to increased costs and higher prices over time. This could further solidify its status among savvy investors looking for long-term stability.

In light of these factors, adjusting your strategy to incorporate this asset could be advantageous. Monitoring central bank policies is essential; any pivot towards easing monetary policies might trigger price surges. Therefore, maintaining awareness of macroeconomic indicators will be crucial in making informed decisions regarding allocation.

With ongoing shifts in currency values and increasing interest in alternative assets, anticipate heightened volatility but also significant opportunities. Positioning strategically now can yield benefits as the landscape evolves over the coming years.