Investing in yourself – the highest ROI activity

Investing in courses that develop your skills can yield substantial returns. Focus on programs that align with industry demands and personal interests, ensuring the education you receive is both relevant and applicable. Consider technical certifications or management training that are recognized within your field.

Education should not be a one-time event; it must be a continuous endeavor. Regularly updating your knowledge through workshops, online platforms, or formal degrees enables you to adapt quickly to market shifts. This proactive approach to learning can significantly enhance your professional profile and increase earning potential.

The journey of personal growth is intertwined with the pursuit of new competencies. Engage in projects that challenge you, collaborate with others who possess different expertise, and seek mentorship opportunities. These experiences not only broaden your understanding but also expand your network, opening doors to new possibilities.

A deliberate strategy combining targeted learning and practical application will lead to noticeable improvements in financial outcomes. Prioritize investments in yourself as they often yield the highest dividends over time.

Identifying High-Potential Assets

Focus on enhancing your skills and prioritize education in emerging fields. Look for sectors such as technology, renewable energy, and biotechnology, which are expected to grow significantly in the coming years. Research companies that exhibit strong fundamentals and innovative capabilities.

Evaluate assets by considering their potential for personal growth. Engage with online courses or certifications related to these industries. This not only increases your knowledge but also positions you advantageously within a competitive job market.

Network with professionals in high-demand areas; their insights can guide you toward lucrative opportunities. Attend workshops and seminars that focus on trending topics, as this will expand your understanding and connect you with key players.

Analyze educational resources–books, podcasts, webinars–that discuss market trends and forecasts. Stay informed about technological advancements that can disrupt traditional models; these insights can help identify lucrative investments before they become mainstream.

Consider investing time in developing soft skills like communication and leadership, which are increasingly valued alongside technical abilities. The combination of hard knowledge and interpersonal skills enhances your adaptability in various environments.

Your future depends on informed decision-making. Assess risks carefully while remaining open to unconventional investment strategies that may yield higher returns over time.

Creating a Diversified Portfolio

Incorporate various asset classes to mitigate risks and enhance returns. Consider the following steps:

- Include Different Asset Types:

- Stocks: Allocate funds in large-cap, mid-cap, and small-cap companies.

- Bonds: Invest in government and corporate bonds for stability.

- Real Estate: Explore REITs or direct property investments for income generation.

- Commodities: Consider gold, silver, or agricultural products as hedges against inflation.

- Diversify Within Each Category:

- Select stocks from different sectors such as technology, healthcare, and consumer goods.

- Choose bonds with varying maturities and credit qualities.

- Add Alternative Investments:

- Taking courses on financial literacy or investment strategies enhances decision-making.Pursuing certifications in finance or trading adds credibility to your profile.

This multifaceted approach ensures that your portfolio is robust enough to weather market fluctuations while positioning you favorably for future growth opportunities. Consistently review and adjust allocations based on performance and changing market conditions.

Monitoring Investment Performance

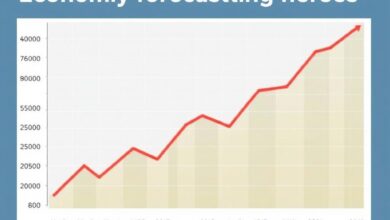

Regularly assess your holdings by setting specific benchmarks related to each asset. This practice allows for a clear understanding of their growth trajectories and potential returns. Utilize tools such as financial dashboards or portfolio management software that provide real-time data analytics to track performance.

Incorporate metrics such as return on investment, volatility, and drawdown to evaluate risk versus reward effectively. Education in quantitative analysis can enhance your ability to interpret these figures accurately, leading to informed decisions about reallocating resources or holding positions longer.

Consider enrolling in courses focused on technical analysis and market trends. Building these skills enables you to predict future movements based on historical data patterns, enhancing your responsiveness to market changes.

Stay updated with economic news and industry reports that might impact your assets. Knowledge in macroeconomic factors will prepare you for shifts that could affect your portfolio’s overall health. Engage with communities of investors; peer discussions can yield insights you may not have considered.

Review your strategy quarterly at minimum, adjusting based on performance evaluations and changing market conditions. This proactive approach ensures that you remain aligned with your long-term financial objectives while optimizing the potential for significant gains over time.

Adjusting Strategies Over Time

Regularly reassess your methodologies based on evolving market dynamics and personal growth objectives. Invest time in education to acquire new skills that align with future trends, allowing for informed adjustments in your approach.

Utilize data analytics tools to track performance metrics. Identify patterns that may indicate when a strategy needs refinement. For instance, if a particular sector shows declining returns, consider reallocating resources to more promising opportunities.

Engage with industry experts and peers through networking. Their insights can provide valuable context for modifying your tactics, ensuring they remain relevant as conditions shift.

Establish a routine for reviewing your portfolio at least quarterly. This practice not only keeps you updated but also fosters continuous learning about the assets you hold, enhancing your ability to adapt swiftly.

Incorporate feedback mechanisms into your strategy. Analyze both successes and failures critically; this reflective process is key for personal development and improving decision-making capabilities over time.

Stay abreast of educational resources–books, courses, webinars–that focus on emerging trends within your areas of interest. This commitment to lifelong learning will empower you to pivot effectively as new information becomes available.

Acquiring knowledge can be an asset itself. Consider these avenues:

- Taking courses on financial literacy or investment strategies enhances decision-making.Pursuing certifications in finance or trading adds credibility to your profile.