The basics of personal finance everyone should know

Master the art of budgeting by tracking your income and expenses meticulously. Create a monthly plan that allocates funds for necessities, savings, and discretionary spending. Aim to save at least 20% of your income; this will lay a strong foundation for future financial goals.

Credit is not just a number; it’s a powerful tool that can open doors to opportunities like home ownership or favorable loan rates. Understand how credit scores work, and ensure you maintain a good score by paying bills on time and keeping credit utilization below 30%.

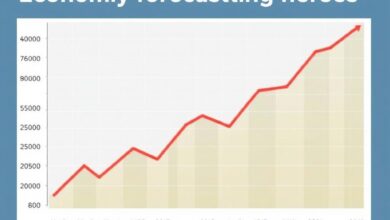

Dive into investing early. Even small amounts can grow significantly over time through compound interest. Consider diversifying your portfolio with stocks, bonds, and mutual funds to mitigate risks while maximizing returns.

A strong grasp of financial literacy is indispensable in today’s economy. Familiarize yourself with terms related to savings accounts, interest rates, and investment vehicles. The more informed you are, the better decisions you’ll make regarding your wealth accumulation strategies.

Creating a Realistic Budget

Allocate 50% of your income to needs, 30% to wants, and 20% to savings. This straightforward approach facilitates effective budgeting and helps in establishing financial literacy.

Begin by tracking all sources of income. Include salary, side hustles, and any passive earnings. Document every dollar to gain insight into your financial flow.

List monthly expenses, categorizing them as fixed (rent, utilities) or variable (entertainment, dining out). Assessing these expenditures reveals areas for potential reduction without sacrificing quality of life.

Incorporate credit management into your budget. Aim to pay off high-interest debt first while maintaining minimum payments on other obligations. This strategy minimizes long-term costs and improves credit scores.

Create an emergency fund by saving three to six months’ worth of living expenses. This cushion protects against unforeseen circumstances like job loss or medical emergencies.

Review and adjust your budget regularly. Life changes–such as income fluctuations or major purchases–require recalibrating your financial plan. Use budgeting apps or spreadsheets for efficient tracking.

Always prioritize saving as part of your monthly expenditure. Automate transfers to savings accounts right after receiving income to reinforce this habit.

Stay disciplined. Avoid impulsive spending that can disrupt your budgeting efforts. Implement a waiting period for non-essential purchases; this helps determine if the expense is truly necessary.

Understanding Credit Scores

Check your credit report regularly. This is crucial for maintaining a healthy credit score, which affects your ability to secure loans and favorable interest rates. Obtain free reports from the three major bureaus: Experian, Equifax, and TransUnion.

Aim for a score of at least 700 to qualify for better credit options. Scores range from 300 to 850, with higher numbers indicating lower risk to lenders. Factors influencing your score include payment history (35%), credit utilization (30%), length of credit history (15%), types of credit used (10%), and recent inquiries (10%).

Pay bills on time; late payments can severely damage your rating. Set up automatic payments or reminders to ensure punctuality. Keep your credit utilization below 30%. If you have a $10,000 limit, avoid exceeding $3,000 in outstanding balances.

Limit new credit applications. Multiple inquiries can indicate financial distress and negatively impact your score. Instead, focus on managing existing accounts responsibly.

Consider diversifying your credit mix. Having different types of credit–such as installment loans and revolving credit–can positively influence your rating if managed well.

Invest in financial literacy resources to deepen your understanding of how scores work and their implications on budgeting decisions. The more informed you are, the better equipped you’ll be to make choices that enhance both your score and overall financial health.

Building an Emergency Fund

Establish a goal of saving three to six months’ worth of living expenses. This cushion protects against unexpected financial setbacks, such as job loss or medical emergencies.

Begin by analyzing your current spending habits through detailed budgeting. Identify non-essential expenses that can be reduced or eliminated. Redirect these funds into your emergency account.

Create a separate savings account specifically for this purpose; it should be easily accessible yet distinct from your regular checking and saving accounts. Consider high-yield savings options to maximize interest while maintaining liquidity.

Automate your contributions. Set up direct deposits from your paycheck into the emergency fund to ensure consistent growth without requiring constant attention.

Aim for incremental increases in contributions over time. If you receive bonuses or tax refunds, consider allocating a portion directly towards this fund rather than adjusting your lifestyle immediately.

Stay disciplined; avoid using these funds for non-emergencies. Cultivate the habit of savings as a priority rather than an afterthought, which will enhance your overall financial health and resilience against uncertainty.

This fund not only alleviates stress but also provides more freedom in making long-term decisions regarding investing and other financial goals, knowing you have a safety net in place.

Investing for Beginners

Begin investing with a clear understanding of your financial goals. Define what you want to achieve: retirement, buying a home, or funding education. This clarity will guide your investment choices.

Start with these practical steps:

- Educate Yourself: Familiarize yourself with basic investment concepts such as stocks, bonds, and mutual funds. Resources like books, online courses, and podcasts can enhance your financial literacy.

- Create a Diversified Portfolio: Spread investments across different asset classes to reduce risk. A mix of equities, fixed income, and other vehicles can provide stability during market fluctuations.

- Consider Low-Cost Index Funds: These funds track market indices and often have lower fees than actively managed funds. They are suitable for beginners due to their simplicity and cost-effectiveness.

- Use Dollar-Cost Averaging: Invest a fixed amount regularly regardless of market conditions. This strategy reduces the impact of volatility on your overall investment cost.

- Avoid Emotional Decisions: Stick to your long-term strategy even during market downturns. Emotional reactions can lead to poor decisions that undermine growth potential.

Your credit profile plays a significant role in investing; lenders evaluate creditworthiness based on scores. A good score may lower borrowing costs for investments like real estate.

Savings also form the foundation for investing. Ensure that an emergency fund is in place before committing excess cash to investments. Aim for three to six months’ worth of living expenses in accessible accounts.

Regularly review and adjust your portfolio based on performance and changing life circumstances. Stay informed about market trends but avoid overreacting to short-term movements.

Investing is not just about wealth accumulation; it’s about building security and achieving personal aspirations over time. Commit to lifelong learning and adaptation in this dynamic landscape.