What is asset-backed investing and how it works

Consider allocating a portion of your portfolio to tangible assets, which can provide both stability and predictable cash flow. This investment type is often overlooked but offers a unique opportunity for those seeking safety amidst market volatility.

Tangible assets, such as real estate or equipment, not only appreciate over time but also generate consistent income. This dual benefit enhances your financial strategy, allowing you to mitigate risks while enjoying reliable returns.

Investing in these physical resources often results in less correlation with traditional financial markets, providing a hedge against economic downturns. Prioritizing safety through asset-backed investments can lead to sustainable growth and long-term wealth accumulation.

Types of Asset-Backed Securities

Mortgage-Backed Securities (MBS) represent loans secured by real estate. These instruments provide cash flow derived from mortgage payments, offering a reliable investment type for those seeking consistent returns. Investors often view MBS as having moderate safety due to the underlying tangible assets.

Asset-Backed Commercial Paper (ABCP) is another category, typically short-term in nature. ABCP is backed by various assets, including receivables and inventory, providing liquidity and cash flow that can be attractive for short-term investment strategies.

Collateralized Debt Obligations (CDOs) are structured financial products that pool different types of debt, including loans and bonds. The safety of CDOs can vary significantly based on the quality of the underlying assets. Investors should carefully analyze the asset composition to assess risk and potential returns.

Auto Loan-Backed Securities focus specifically on automobile financing. These securities offer cash flows from borrowers’ payments on auto loans, appealing to investors looking for predictable income streams associated with tangible assets like vehicles.

Student Loan-Backed Securities have gained traction as education funding becomes increasingly vital. They generate cash flows from student loan repayments, though their safety can fluctuate based on economic conditions affecting borrowers’ ability to repay.

Each type presents distinct characteristics and risks. A thorough understanding of these variations aids in selecting the appropriate instrument aligned with individual investment goals and risk tolerance.

Risk Assessment Techniques

Prioritize the evaluation of tangible assets when assessing risk in secured investments. Conduct thorough due diligence to verify the underlying collateral’s quality and marketability. Analyze historical performance data and current valuation metrics of these assets to gauge their stability.

Implement a comprehensive credit risk analysis, focusing on the creditworthiness of the borrowers or issuers involved. Utilize credit ratings, default probabilities, and financial statements to assess potential risks effectively.

Incorporate stress testing scenarios that simulate adverse market conditions. This approach helps determine how changes in interest rates, economic downturns, or asset depreciation could impact the investment type’s safety.

Monitor regulatory frameworks relevant to these securities. Changes in laws can affect asset values and repayment structures significantly. Keeping abreast of legal developments ensures timely adjustments to risk assessments.

Utilize diversification strategies across different types of secured investments. By spreading exposure among various asset classes, you can mitigate specific risks associated with individual assets while enhancing overall portfolio resilience.

Lastly, engage in continuous performance monitoring post-investment. Regularly reviewing key indicators allows for proactive measures should any deviations from expected outcomes arise, safeguarding your capital over time.

Investment Strategies Explained

For those looking to optimize returns through tangible assets, several strategies can effectively harness cash flow generated by secured investments.

- Income Generation: Focus on securities that yield consistent cash flow. Prioritize assets with reliable payment histories to ensure steady income streams.

- Diversification: Spread investments across various types of asset-backed instruments. This mitigates risks associated with any single investment type and enhances overall portfolio stability.

- Credit Quality Analysis: Assess the credit ratings of underlying collateral. High-quality backing reduces default risk and supports more predictable cash flows.

- Maturity Matching: Align investment durations with cash flow needs. Short-term instruments may be suitable for immediate liquidity, while longer-term options can offer higher yields over time.

- Market Timing: Monitor interest rate trends and economic conditions. Entering positions during favorable market phases can maximize returns on secured securities.

Implementing these strategies requires an analytical approach, focusing on the financial health of the underlying assets and their capacity to generate income consistently. By combining these techniques, investors can build a robust portfolio aimed at achieving both growth and stability.

Market Trends and Insights

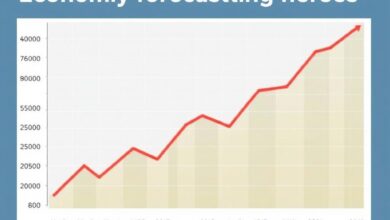

Focus on tangible assets is reshaping the investment type landscape. Investors are increasingly drawn to securities backed by physical items, driven by their inherent value and potential for steady cash flow. This shift towards hard assets offers a level of safety that traditional financial instruments often lack.

Data indicates a growing preference for collateralized securities in sectors like real estate and automotive finance. For instance, mortgage-backed securities have seen a resurgence as home values stabilize, presenting opportunities for consistent returns tied directly to property appreciation. Similarly, auto loan-backed products demonstrate resilience due to strong consumer demand for vehicles.

Emerging markets also play a pivotal role in current trends. Investors are looking at international asset classes, particularly in regions with burgeoning economies where tangible assets can provide significant appreciation potential. Diversifying into these markets can enhance portfolio robustness while mitigating risk.

Moreover, regulatory changes are influencing investor sentiment. Enhanced transparency requirements are fostering confidence among stakeholders, encouraging more capital inflow into backed securities. This trend signals an optimistic outlook for future growth within this sector.

To capitalize on these shifts, focus on thorough market research and asset evaluation techniques. Understanding the underlying fundamentals of tangible assets will be paramount in identifying promising investment opportunities that align with risk tolerance and return expectations.