What is compound interest and how it builds wealth

To amplify your financial trajectory, prioritize consistent contributions to a savings vehicle that harnesses the power of compounding returns. This approach transforms modest initial deposits into substantial future assets over time. The key lies in patience and a long-term perspective, allowing your money to work for you rather than against you.

Engaging in regular investments can exponentially enhance your financial foundation. By selecting options with favorable compounding rates, even small amounts can grow significantly as they accrue earnings on both principal and previously earned returns. This multiplication effect is particularly pronounced over extended periods, making early and repeated contributions vital for maximizing potential.

Consider setting up automatic transfers to your savings account or investment portfolio. This tactic not only enforces discipline but also takes advantage of market fluctuations without emotional interference. The sooner you start this practice, the greater the impact on your overall financial health–positioning you for a more prosperous future.

How Compound Interest Works

Maximizing your savings involves harnessing the power of growth through reinvestment. The mechanism operates by applying a percentage yield on both the principal and any previously accrued earnings. This creates a cycle where each period’s returns are calculated on an increasing balance, which accelerates wealth accumulation over time.

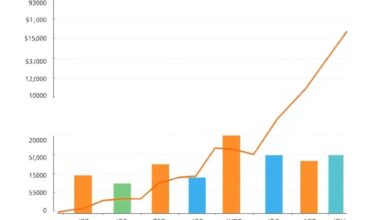

For effective long-term financial planning, it’s essential to start early. A small initial deposit can snowball into significant amounts due to the magic of multiplication over years. For instance, investing $1,000 at an annual rate of 5% could yield approximately $1,628 after ten years–demonstrating how even modest contributions can flourish through consistent compounding.

The frequency of compounding also plays a critical role. Monthly or daily calculations will enhance total returns compared to annual assessments. Choosing accounts or investment vehicles that offer frequent compounding can significantly impact your savings trajectory.

Monitor your investments regularly and consider reinvesting dividends and interest payments to further amplify growth. This strategy ensures that every dollar works hard, contributing to the overall increase in your capital.

Ultimately, patience is vital; allowing time for your savings to accumulate will lead to exponential results that straightforward interest calculations cannot match. Embrace this strategy for a robust financial future.

Calculating Your Investments

To maximize your financial resources, focus on precise calculations that reveal the potential of your assets. Use the formula for future value to project savings over time:

Future Value = Principal × (1 + Rate/Number of Compounding Periods)^(Number of Compounding Periods × Years)

- Principal: Initial amount invested.

- Rate: Annual percentage yield expressed as a decimal.

- Number of Compounding Periods: Frequency of compounding (e.g., annually, semi-annually).

- Years: Duration the money is invested or borrowed.

This formula allows you to visualize how savings can grow exponentially through regular contributions and reinvestment. Consider these steps for effective investment calculation:

- Select a realistic rate: Research historical returns for various asset classes to find an attainable growth rate.

- Determine your timeline: Align your investment horizon with your financial goals–short-term versus long-term strategies will yield different outcomes.

- Create a consistent contribution plan: Regular deposits amplify the impact of earnings, leveraging the power of reinvestment.

A practical example: If you invest $1,000 at an annual return of 5%, compounded annually, after 10 years, you would have approximately $1,628.89. This illustrates how even modest rates can lead to significant increases in value over time.

Your strategy should also factor in inflation and market volatility; adjust expectations accordingly. Calculate potential scenarios using different rates and timelines to prepare for uncertainties and optimize performance.

The art lies in being proactive–frequently reassess your investments against your objectives to ensure they remain aligned with your aspirations. Remember: Every dollar saved today builds towards a more substantial financial future tomorrow.

Strategies for Maximizing Growth

Prioritize automatic contributions to your savings. Setting up regular deposits ensures a consistent increase in your capital, amplifying the benefits of reinvestment over time.

Diversify your investment portfolio. Allocate funds across various asset classes like stocks, bonds, and real estate to mitigate risks while enhancing potential returns. This multi-faceted approach can significantly accelerate wealth accumulation.

Take advantage of tax-advantaged accounts. Utilizing IRAs or 401(k)s allows you to grow your investments without immediate tax implications, which can substantially boost overall returns in the long run.

Reinvest all earnings. Opt for reinvestment options instead of cash payouts from dividends or interest payments. This practice accelerates the compounding effect, leading to exponential growth in your savings.

Regularly review and adjust your strategy. Periodically assess your investment performance and market conditions to ensure alignment with your financial goals. This proactive management helps maintain momentum in wealth accumulation.

Consider longer-term investments. While short-term gains may be tempting, focusing on assets that appreciate over several years typically yields higher returns through sustained compounding effects.

Minimize fees and expenses associated with your investments. High management fees can erode returns significantly over time; therefore, opting for low-cost index funds or ETFs can enhance net growth.

Stay informed about market trends and economic factors affecting your investments. Knowledge empowers better decision-making, enabling you to seize opportunities that align with your long-term financial objectives.

Avoiding Common Mistakes

Regularly assessing and adjusting your savings strategy is crucial. Many individuals overlook the impact of fees associated with investment accounts. High fees can significantly erode returns over time, reducing the benefits of your accumulated earnings. Opt for low-cost index funds or ETFs to keep expenses minimal.

Another frequent error is neglecting to reinvest earnings. Failing to direct dividends or interest payments back into the investment can stunt potential compounding effects, slowing down overall accumulation. Ensure that all earnings are reinvested to harness maximum growth.

Timing the market is a common pitfall. Attempting to predict fluctuations can lead to missed opportunities and increased risk. A consistent, long-term approach is more effective than trying to chase trends or react to short-term changes.

Ignoring inflation’s impact on purchasing power diminishes real returns. Regularly review your strategies to ensure that growth outpaces inflation rates; otherwise, savings may lose value over time.

Lastly, maintaining an unrealistic expectation of returns can lead to disappointment and poor decision-making. Understand average performance metrics and set achievable goals based on historical data rather than speculative forecasts.