What is financial independence and how to achieve it?

To escape the grind of a 9-to-5 existence, focus on generating passive income. This approach allows you to cultivate wealth without sacrificing your lifestyle. Invest in real estate or create digital products that can generate revenue while you sleep. Aim for an income stream that requires minimal daily effort after the initial setup.

The FIRE (Financial Independence, Retire Early) movement emphasizes living below your means and investing wisely. By adopting frugal habits and directing savings into index funds or dividend stocks, you can build a financial cushion that leads to freedom. Set specific milestones for your investments; this clarity will drive your commitment and help track progress.

Your lifestyle choices play a crucial role in this process. Evaluate your expenses critically and eliminate non-essential costs. Redirect those savings towards income-generating assets. The less you need to cover daily living expenses, the quicker you’ll reach a state of autonomy.

Embrace the mindset that prioritizes long-term gains over immediate gratification. Each step taken toward financial self-sufficiency brings you closer to a life where work is optional, not obligatory. The true essence of freedom lies in having choices–choices made possible by smart investment strategies and disciplined saving habits.

Defining Your Financial Goals

Set clear, measurable targets for your wealth creation. Specify an annual income goal that aligns with your desired lifestyle. For instance, aim for a passive income of $50,000 per year to support travel and leisure activities.

Determine the timeframe for achieving these goals. A five-year plan might involve building a portfolio that generates consistent returns through investments in real estate or dividend stocks.

Identify the specific sources of passive income you want to pursue. This could include rental properties, online businesses, or stock market dividends. Each source should be evaluated based on its potential return and the effort required to maintain it.

Visualize your ideal lifestyle once you reach financial freedom. Sketch out daily activities and expenses–this clarity will motivate you to stay committed to your plans.

Regularly review and adjust your goals as circumstances change. Life events may necessitate a reevaluation of what financial success looks like for you; flexibility is key.

Create a monthly budget that reflects your priorities while allocating funds toward savings and investments aimed at achieving your income objectives. Stick to this budget rigorously to build momentum towards financial security.

Engage with resources such as books, podcasts, or seminars focused on wealth-building strategies tailored to your interests. Knowledge expands possibilities and encourages innovative approaches.

Network with individuals who share similar aspirations. Surrounding yourself with like-minded people can provide inspiration and accountability on your path toward economic liberation.

Creating a Realistic Budget

Begin with tracking all income sources, including salaries, investments, and any passive income streams. This sets the foundation for your budget.

- List all fixed expenses: rent, utilities, insurance, and loan payments.

- Identify variable expenses: groceries, entertainment, dining out.

Next, categorize your spending. This allows you to see where your money goes and helps in prioritizing savings towards your money goals.

- Essential Needs: Allocate funds for necessary living costs.

- Financial Goals: Dedicate a portion for savings or investments aimed at achieving freedom from traditional work.

- Lifestyle Choices: Decide how much to spend on non-essentials without compromising financial objectives.

Aim for the 50/30/20 rule: 50% on needs, 30% on wants, and 20% toward savings or debt repayment. Adjust this according to personal circumstances and aspirations.

- Regularly review and adjust the budget monthly based on actual spending patterns.

- Create an emergency fund as part of your budgeting strategy; aim for three to six months’ worth of expenses.

This approach will help balance lifestyle desires with long-term financial goals while paving the way toward sustainable passive income opportunities. The objective is not just to save but to ensure that spending aligns with values and aspirations for true freedom in life choices.

Investing for Long-Term Growth

Focus on diversification to mitigate risks while pursuing your money goals. Allocate funds across various asset classes, such as stocks, bonds, and real estate. This strategy not only stabilizes returns but also positions you for potential wealth accumulation over time.

Start with index funds or exchange-traded funds (ETFs) that track major market indices. These options provide broad market exposure with low fees, enhancing your ability to generate passive income. Aim for a mix of large-cap and small-cap equities to balance growth and stability.

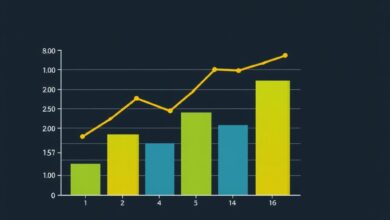

Create a long-term investment plan that aligns with your vision of financial freedom. Regularly review and rebalance your portfolio to maintain desired allocations. Consider dollar-cost averaging; invest consistently regardless of market conditions, reducing the impact of volatility.

Dive into dividend-paying stocks to increase passive income streams. Reinvest dividends to accelerate growth compounding effects over years. Monitor companies’ financial health and payout ratios to ensure sustainability of dividends.

Pursue tax-advantaged accounts like IRAs or 401(k)s for retirement savings. Contributions grow tax-free, enhancing your overall return on investment. Maximize employer matches if available–this is essentially free money toward your financial aspirations.

If you’re inclined towards alternative investments, explore peer-to-peer lending or crowdfunding platforms that can yield higher returns than traditional avenues. However, assess the associated risks carefully before committing capital.

Your path towards fire requires consistent effort in managing investments wisely. Educate yourself continuously on market trends and economic indicators that influence asset performance, adapting strategies as necessary while keeping your long-term objectives in sight.

Building Multiple Income Streams

Create avenues for passive income to secure your money goals and enhance freedom. Consider real estate investments, which can generate rental income while appreciating in value. Explore dividend-paying stocks that provide regular cash flow without the need for active involvement.

Start a side business aligned with your skills or interests. This could be anything from freelancing to creating an online store. Leverage platforms like Etsy or Amazon to reach a wider audience with minimal upfront costs.

Invest in peer-to-peer lending or crowdfunding opportunities. These platforms allow you to earn interest on loans given to individuals or small businesses, diversifying your portfolio and increasing potential returns.

Monetize hobbies by creating digital products such as e-books, courses, or stock photography. Once created, these assets can continuously generate revenue over time with little ongoing effort.

Consider developing a blog or YouTube channel focused on niche topics that attract viewers and advertisers. With consistent content creation, these channels can become substantial sources of passive income through ad revenue and sponsorships.

Diversifying your income streams not only speeds up the path to financial security but also enhances resilience against economic fluctuations. Each stream contributes to a larger pool of resources that supports your journey towards freedom and self-sufficiency.