How to plan big purchases using investment income

Set clear objectives before engaging in substantial financial commitments. Determine the amount you wish to allocate and the anticipated returns over time. For instance, if you’re eyeing a home priced at $300,000, calculate how much monthly savings you need to set aside, considering an investment vehicle that generates a 6% annual return. This could translate into approximately $1,500 saved each month over five years.

Utilize real examples to illustrate effective saving techniques. A young couple aiming to buy their first home can explore high-yield savings accounts or diversified portfolios that include stocks and bonds. If they manage to secure an average return of 8%, their savings could grow significantly faster than traditional methods.

Always assess risk versus reward. While chasing higher returns can be enticing, it’s essential to maintain a balanced approach tailored to your financial situation and goals. Adjust your strategy based on performance and market conditions to ensure sustainable growth towards your purchasing aspirations.

Assessing Your Financial Goals

Establish clear, measurable objectives for your finances. Break down long-term aspirations into short-term milestones to track progress effectively. For instance, if your aim is to buy a home in five years, calculate the total amount needed and set aside a specific monthly savings target.

Use real examples to illustrate your financial journey. If you plan to acquire a vehicle worth $30,000 in three years, determine how much you need to save each month by dividing the total by the number of months until purchase. Incorporate expected returns from investments to reduce the burden of saving alone.

Regularly revisit and adjust these goals based on changes in your life circumstances or market conditions. If an unexpected expense arises or if your income increases, refine your saving strategy accordingly. This adaptability ensures that you’re always aligned with your financial ambitions.

Consider diversifying your savings approach by allocating funds into different investment vehicles suited to your timeline and risk tolerance. A mix of conservative and aggressive options can provide both stability and growth potential as you work towards fulfilling your aspirations.

Ultimately, success hinges on discipline and continuous evaluation of progress against these outlined finance goals. Keep records, celebrate small achievements, and stay focused on the end game: realizing those significant acquisitions that enhance your lifestyle.

Choosing Investment Vehicles Wisely

Select financial instruments that align with your objectives and risk tolerance. For instance, if your goal is to secure a stable return for a future purchase, consider bonds or dividend-paying stocks. These options often provide reliable cash flow while minimizing volatility.

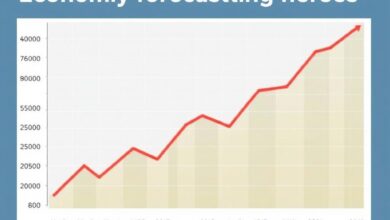

Examine historical performance data of various assets. Real examples reveal that over the past decade, certain index funds have yielded annual returns averaging around 7-10%, which can significantly contribute to your savings over time. Compare these figures against traditional savings accounts that barely keep pace with inflation.

Understand the tax implications of each vehicle. Tax-efficient accounts like IRAs or 401(k)s can enhance long-term growth by deferring taxes on gains. This strategy can maximize the capital available for your specific finance goals.

Diversification is key; blend different asset classes to balance risk and reward. A mix of equities, fixed income, and perhaps real estate investment trusts (REITs) can cushion against market fluctuations while aiming for higher returns.

Regularly review your portfolio’s performance in light of changing circumstances and objectives. Adjust allocations as needed to ensure alignment with your aspirations–whether it’s funding education or purchasing a home.

Calculating Required Income Streams

Determine the precise amount of funds necessary to achieve your financial aspirations. This process starts with a clear understanding of your anticipated expenses and timelines.

- Identify Your Goals:

- List specific purchases or investments you aim to make.

- Estimate the total cost for each goal.

- Set a timeline for when these expenditures will occur.

- Calculate Monthly Needs:

- Add up all projected costs and divide by the number of months until the purchase.

- This gives you a monthly income target to meet your objectives.

- Assess Savings and Returns:

- Evaluate your current savings and potential investment returns.

- Consider various financial products that align with your risk tolerance and time horizon, such as stocks, bonds, or mutual funds.

- Diversify Income Sources:

- Aim for multiple revenue streams to minimize risk. Explore options like dividend stocks, rental properties, or peer-to-peer lending.

- Diversification can enhance overall returns while providing stability against market fluctuations.

- Monitor Progress:

- Regularly review your savings and investment performance against your goals.

- If you’re falling short, reassess either your spending habits or return expectations on investments.

This structured approach ensures clarity in achieving desired financial outcomes while maintaining focus on effective saving methods and maximizing returns through strategic asset allocation.

Timing Purchases for Optimal Returns

Evaluate market cycles and identify the right moments to invest your resources. Align your acquisitions with periods of low asset prices, ensuring you capitalize on potential appreciation.

Analyze seasonal trends. Certain industries experience fluctuations based on time of year; align your financial commitments accordingly to take advantage of these patterns.

Monitor interest rates closely. A decline in borrowing costs can enhance your purchasing power, allowing you to secure better deals or larger assets without significantly increasing financial strain.

Utilize economic indicators as signals. Keep track of inflation rates, consumer confidence indexes, and employment statistics; these metrics can help predict favorable times for spending.

Consider dollar-cost averaging when investing in volatile markets. Gradually allocate funds over time rather than all at once, minimizing risk while potentially maximizing returns during fluctuating conditions.

Prioritize liquidity needs. Ensure that any significant expenditure does not compromise your ability to respond to unexpected expenses or opportunities that may arise.

Engage with experts and leverage technology tools for predictive analytics. Staying informed and using data-driven insights will enhance decision-making regarding optimal timing for financial commitments.